Competitive Edge

May, 17th 2023

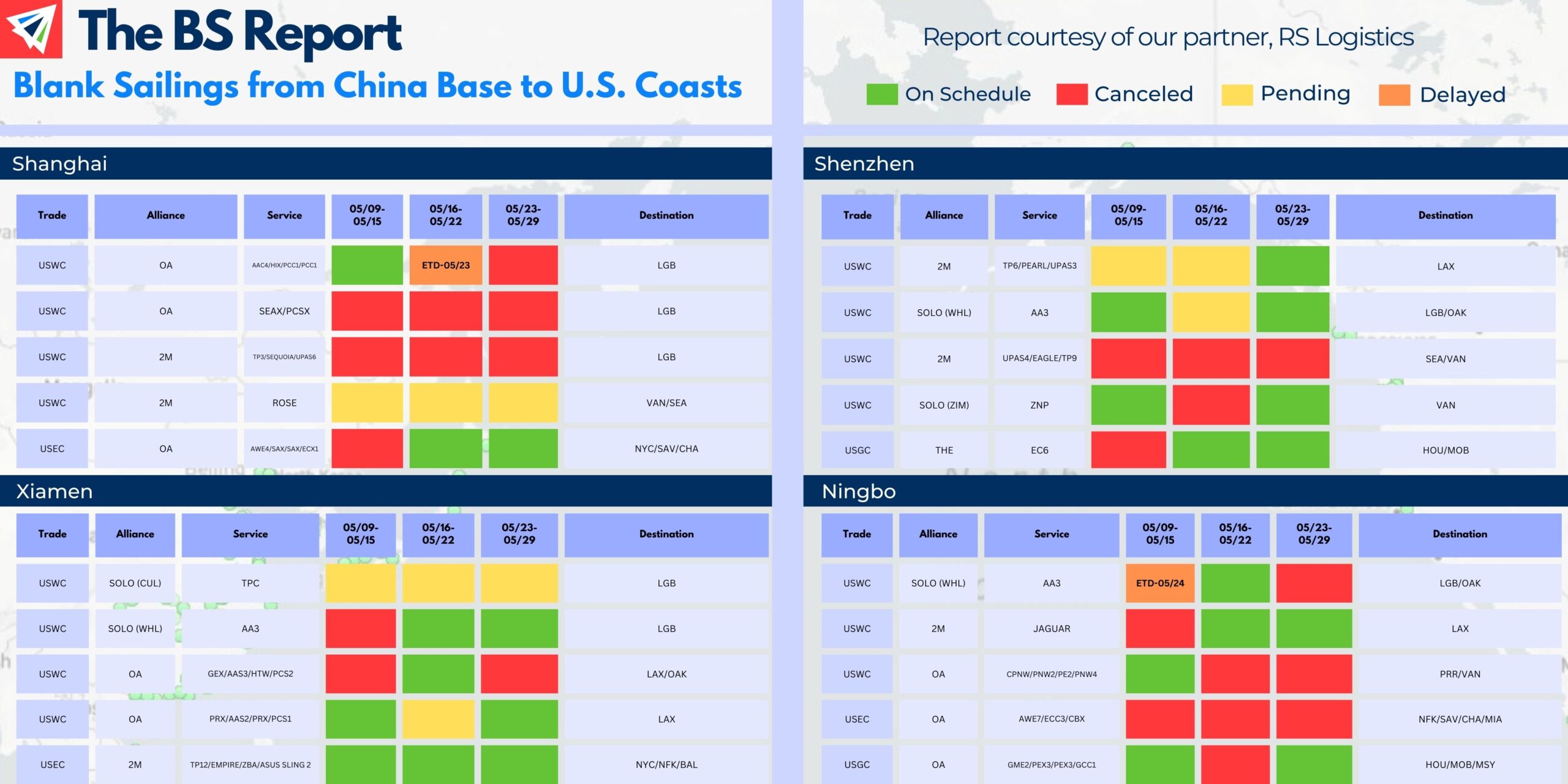

Note the above services are where the greatest number of blank sailings are occurring on the transpacific eastbound lane. Other services as well may have announced cancellations or delays.

Please contact us if there is a specific service you are concerned about.

Courtesy: Interlog’s partner RS Logistics provided these schedules.

IMPORT: Asia to North America (TPEB)

Recent Developments:

• West Coast contract negotiations remain active. The existing labor contract between the two parties expired July 1, 2022.

Rates: General rate increases (GRIs) remain in the market, however no firm announcements yet on more increases in mid-May or June from major carriers.

Space: Space is open.

Capacity: Open but carriers will deploy certain tactics to curb low demand.

Equipment: Available at virtually all inland and coastal points. Chassis access can still pose demurrage headaches for intermodal, however.

TIPS:

• Keep a pulse on inventory and be sure to have a logistics gameplan in place for your next orders.

• Pay special attention to how carriers are coping with this lull in the market.

• Hold your logistics partners accountable on frequent updates regarding blank sailings, rate increases, or any other carrier tactics.

IMPORT: Europe to North America (TAWB)

Rates: Rates are dropping at a consistent, steady, and slow clip.

Space: Space is open.

Capacity: Capacity is open.

Equipment: Availability on both origin and destination sides, unless advised otherwise.

TIPS:

• Book at least three weeks prior to ready date.

• Rates, while falling, are still high compared to other trades. Carriers still possess a degree of power in the transatlantic over the shipper (as opposed to the transpacific). Keep these dynamics in mind.

• Premium add-ons (i.e., no-roll options and improved cargo reliability) remain assurances shippers should consider with transatlantic service.

EXPORT: North America to Asia

Rates: Rates are low and level.

Space: Space is wide open.

Capacity: Capacity is widely available for all services.

Equipment: Availability at virtually all inland points and seaports. However, chassis, like for importers, can pose challenges for intermodal movement.

TIPS:

• Book at least two weeks prior to the time of departure.

• Shippers with high volume projects should take advantage of carrier receptiveness to take on these opportunities. Space is wide open with a high acceptance rate.

• Exporters ought to have their fingers crossed and hope a new West Coast contract is finally introduced. The impacts of this labor impasse have bled into the export market.

InterlogUSA Proudly Presents: FreightFM Episode 8

Check out our latest episode where Interlog’s Marketing Manager, Rachel Thielen, discusses the impact blank sailings and slow steaming have on the market.

FreightFM features short-form video interviews with InterlogUSA’s industry experts offering insights into breaking news, market trends, our company’s history, and more!

Did You Know: ONE Becomes the Latest to Drop Per Diem Fees

ONE joins the list of ocean carriers who will stop assessing detention and demurrage fees when a marine terminal is closed.

Maersk, HMM, Hapag Lloyd and MSC have all announced updates on these fees, in past weeks.

These changes by the ocean carriers come in preparation of the FMC’s final rule on detention and demurrage billing, which is set to be published in the middle of June.

Read More: JOC

Freight News

Current State of Air Freight

Optimism is fading for airfreight recovery as retailers are taking a ‘wait and see’ approach on consumer views. So, what does air freight currently looks like? Will it improve? And how does inventory play a role?

Currently global air cargo volumes are down between 8 and 10 percent from the elevated levels last year, while rates continue to nosedive.

Some industry experts are suggesting that the international freight recession has yet to hit bottom, with the best outcome for air cargo providers not happening until October, potentially. Which is when the typical peak season for the movement of goods occurs.

There are a couple things that are influencing the change in attitude towards airfreight demand:

- Lackluster manufacturing activity

- A growing realization that some companies are putting a pause on refilling their broad inventories due to concerns about consumer spending as the global economy continues to decelerate

A common opinion shared from those in the retail and manufacturing industries say inventory levels are normalizing and bookings will pick up eventually, but some still caution against over relying on inventory data for forecasts.

Ocean Container Demand So Far in 2023

Near the end of 2022, optimism emerged that ocean container demand may potentially increase or “boom”, once the zero covid restrictions in China ended. But what does that optimism look like now?

Well, that optimism is not as high as it was near the end of last year.

Of course, there will be some discrepancies as import volumes last year were seeing record highs. So, it’s a little unfair to compare what we’re now seeing in import volumes to what they were like last year.

Additionally, it’s not all doom and gloom. Interestingly enough, monthly imports are looking more like what they were back in 2019, pre-pandemic.

Here’s a great graph that shows U.S. container import volume (TEUs) from January 2019 through April 2023.

Watch Today's Webinar!

Topics: Transatlantic Trade Lane Updates, Technology: the difference between technology visibility and qualified industry experts to fix/improve each shipment, In the News and Market Updates!

Sign Up For Our June Webinar!

Our next webinar is on Wednesday, June 21st, at 10am CST!

Topics will be announced in the next couple of weeks. If you have any questions or specific topics/news you would like our experts to discuss in future webinars, please reach out to us!

What is Coffee & Cargo? Every month, our experts sit down to discuss what’s currently happening in the shipping industry. Every so often we are joined by special guests, who share their specific expertise and experiences.

Interlog  Insights

Insights

In last week’s insights, we answered our first Shipper Hotline question – “Do we have an online tracking and tracing portal?”

“While we can say yes, we also would mention the balance between visibility within technology and qualified people to fix things when something changes or needs fixing.”

Reach out to us if you’d like to hear our experts’ full answer!

We also discussed how ports in the U.S. continue to value terminal expansions. Plus, how have the alcohol and toy industries fared so far in 2023?

“A pretty cool spot for a small town like Paducah,” says Interlog’s Tara Brooking as she basks at the barges passing by on the Ohio River.

Nearby, where she took these photos, is the Paducah-McCracken riverport. The port is situated on 48-acres and has more than 27-acres of land storage capacity. The barges, like the one’s seen here, mostly transport grain, steel, logs, and other bulk cargoes.

Paducah isn’t just a small town with an unassuming port either. Its location suggests nothing other than pure strategy regarding logistics.

The western Kentucky town is close to Interstate-24 with around 15 truck terminals in the vicinity while also only 50 miles east down the Ohio River from the Mississippi River. The latter waterway is directly connected to the Gulf of Mexico.

Sign up for our

industry answers

Our team works to provide valuable, unique, and relevant content to assist you in finding solutions. Sign up now.