Competitive Edge

December 6th, 2023

Stay Current with InterlogUSA

Latest Industry Happenings and Market Updates:

IMPORT: Asia to North America (TPEB)

Recent Developments:

- Potential labor disruptions along the U.S. East and Gulf coasts in late 2024 (if a new dockworker contract is not reached) has led to some uncertainty among shippers.

- Severe draft restrictions at the Panama Canal are expected to continue into February 2024. This includes reducing the number of vessels transiting the canal each day to just 18 by then.

Rates: Rates remain low. Surcharges on any cargo transiting through the Panama Canal.

Space: Space is generally open, but certain services have seen tightening.

Capacity: Blank sailings are expected to continue into Chinese New Year as carriers remain managing their overcapacity.

Equipment: Issues with railcar availability have since subsided.

TIPS:

- Consider routing alternatives around the Panama Canal. While other options may initially come at higher costs and transits, avoiding the canal’s disruptions may prove justified in the long run.

- Hold your logistics partners accountable for frequent updates regarding blank sailings, rate increases, or any other forms of carrier maintenance.

- Establish a firm timeline for future import activity.

IMPORT: Europe to North America (TAWB)

Recent Developments:

- Carbon-related surcharges have been announced by ocean carriers ahead of the shipping industry’s indoctrination to the EU emissions trading system in January. For more information.

Rates: Rates have plateaued after jolting up. However, with low demand, it’s likely that they will begin to decrease in the coming weeks.

Space: Space is open.

Capacity: Capacity is plentiful with no major adjustments from carriers yet.

Equipment: Availability on both origin and destination sides, unless advised otherwise.

TIPS:

- Book at least three weeks prior to the ready date.

- Carriers have yet to take aggressive action, like they have in the Pacific, regarding capacity management. However, this trade is not profitable for them in its current state, so be on the lookout as they may become more emboldened.

EXPORT: North America to Asia

Recent Developments: The Panama Canal’s deteriorated conditions has led to a routing shift for U.S. farm exports via the Suez Canal.

Rates: After sliding through October, outbound rates have levelled off—remaining relatively low. However, for exports rerouted through the Suez Canal, rates are notably higher than traditional Panama Canal routing.

Capacity: Schedule reliability can be fickle in pockets.

Equipment: A tricky import market has spurred on rail car availability issues.

TIPS:

- Insufficient communication with sailing schedules can lead to higher detention and demurrage fees as well as higher trucking and storage costs. Ensure your logistics partners are not keeping you and your cargo in the dark.

- Routings via the Suez Canal have higher transit times and rates, however the opportunity cost between this alternative versus potential collateral from outstanding disruptions at the Panama Canal should be weighed.

Watch November's Webinar!

FEATURING: Special Guest, Andre Winters – Interlog’s Director of Branch Development

TOPICS: Our experts talk extensively about the Panama Canal: latest updates, impact the issues/challenges the canal’s having on shippers/carriers, potential rerouting options, and more.

Sign Up For Our December Webinar!

Our next webinar is Wednesday, December 20th, at 10am CST!

One topic we will be discussing is the upcoming Chinese New Year. Other topics will be announced in the coming weeks.

If you have any topic suggestions or questions for our experts..

please reach out to us at [email protected]

What is Coffee & Cargo? Every month, our experts sit down to discuss what’s currently happening in the shipping industry. Every so often we are joined by special guests, who share their specific expertise and experiences.

Freight News

USDA is Investing $200 Million to Help Agricultural Exporters

The $200 million that the USDA is investing will go towards 185 projects in 37 states to help agricultural exporters broaden their refrigerated storage facilities, buy new equipment and develop new farms.

U.S. agricultural exports are down 13 percent year-over-year for the first nine months of this year. As you can see in the graph below, agriculture exports are the lowest since 2017.

This new funding is part of an effort to increase economic opportunities for farmers and reduce food costs for U.S. residents, said Tom Vilsack, the Secretary of Agriculture.

Some of the investments include a near $30 million expansion of a California almond and nut processing plant to increase production; $29 million towards development of a 35-acre tomato greenhouse and processing facility in South Carolina. Plus, $15 million towards funding of new equipment at a meat processing plant located in Oklahoma.

Carriers Weighing Options Between Suez and Panama Canals

Currently the Panama Canal is dealing with significant drought, which has caused daily ship transits to decrease in the coming months. Because of this, THE Alliance has started to divert some of their ships to the Suez Canal.

And while the Suez Canal has been touted as a good re-routing option instead of the Panama Canal, some reports are showing that some carriers are weighing their options with the Suez Canal, due to tensions out in the Middle East.

THE Alliance diverting some ships to the Suez Canal:

For ships on three of their weekly container services between the U.S. and Asia, ocean carriers apart of THE Alliance will halt their Panama Canal transits and instead divert those ships through the Suez Canal.

This is expected to go through February, the JOC reports.

Hapag-Lloyd said the two services to the U.S. East Coast – the EC1 and EC2 – along with the EC6 service that calls the Gulf Coast, will use the Suez Canal for their U.S. bound voyages throughout this unique Panama Canal situation. Click here for a closer look.

Carriers considering other options besides Suez Canal:

Some carriers are considering other options due to tensions in the Middle East impacting the Red Sea route.

This past weekend there was an attack on three vessels, one being an OOCL container ship that was heading north to the Mediterranean, the JOC reports.

Additionally, some carriers are or already have implemented ‘war risk’ surcharges.

Starting January 1st, 2024 – Hapag-Lloyd will implement a surcharge for exports and imports in the Intra–Mediterranean and North Europe, as well as exports and imports to all other origins and destinations.

Back on October 12th, ZIM announced a ‘war risk’ surcharge, here is the updated surcharges.

The Suez Canal is a crucial transit area for trade lanes that connect Asia to Europe, as well as linking Southeast Asia and India with the U.S. East and Gulf Coasts.

If you’re concerned how this could impact your shipments, or if you’d like more information…. Talk with one of our experts today.

A Podcast by InterlogUSA: NEW FreightFM Episode

Check out episode 13: “Tis the Season: Holiday Trucking and Consumer Spending!”

Interlog’s Emily Smith, Harry Lien and Owen Campbell sit down and discuss consumer spending and trucking conditions ahead of the uncertain holiday season!

FreightFM features short-form video interviews with Interlog’s industry experts offering insights into breaking news, market trends, our company’s history, and more!

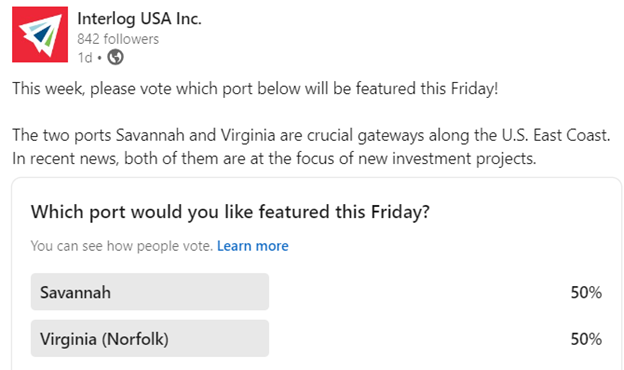

Vote in This Week’s ‘Port of the Week’ Poll

Every other week we post a poll on our LinkedIn page, where you can cast your vote on which port you would like to see featured in our deep dive this Friday.

Vote on this week’s port poll battle: Port of Savannah vs. Port of Virginia (Norfolk).

Consider subscribing to our biweekly “Port of the Week!” newsletter to continue getting a closer look at various ports (and inland ports), globally and domestically.

Interlog  Insights

Insights

Over 200 million consumers went shopping either in-person or online – sign up for Interlog Insights to read more about it.

We also discussed Bath and Body Work’s $100 million lawsuit against the world’s largest ocean carrier.

Sign up for our

industry answers

Our team works to provide valuable, unique, and relevant content to assist you in finding solutions. Sign up now.